- Is it better to save or invest?

- What points should we pay attention to to choose one of these two methods?

savings or investment

In order to know whether it is better to save or to invest, it may not be bad to first provide a definition of these two concepts. Because many times these two concepts are mistakenly used interchangeably:

When we talk about saving, we mean putting money aside for when we need it. With this definition, when we keep our money in cash at home or put it in current bank accounts or loans, we have made some kind of savings.

But when we spend our money on things that we expect to grow in value in the future, we have made an investment. Like buying gold or buying stocks, it is a type of investment. But as mentioned, putting money in the bank’s current account is a kind of savings.

Labels: Order to build a Forex robot , Build a stock trading robot , Build a trading robot , Trader robot design , Free Forex Robot , Forex robot programming , Forex Expert Making Tutorial , Build a trading robot with Python , Download Forex Trading Robot , Buy Forex Trader Robot , Automated Forex Robot , Free stock trading robot , Learn how to build a Forex trading robot , Alpari trading robot , Forex robot for Android , MetaTrader robot design , MetaTrader robot programming , Forex robot design , Forex robot programming , Automated trading

which one is better? Investment or savings

As you know, our country is an inflationary country and in the last fifty years we have usually faced double-digit inflation. So if we keep the money we earn at home, if we assume that we will have 30% inflation this year, at the end of the year we have lost 30% of the value of our assets.

In contrast to savings, we are faced with the concept of investment. Investing not only preserves the value of our property, but can also greatly help our financial growth. Of course, this point should also be taken into account that investment, along with its many benefits, also has one drawback, and that is risk.

There are various investment methods. But two parameters are important in these types of investment. First , the amount of investment return and second, the amount of investment risk .

◊ Also read this article: How to calculate the gold coin price bubble?

return on investment

The return on investment is indicated by the abbreviation ROI, which is taken from the beginning of the words Return Of Investment. In the simplest definition, return on investment is the rate by which the efficiency of an investment is evaluated. Mathematically, it can be calculated using the following formula:

For example, if you bought ten million tomans worth of gold and after one year the value of your gold reached eleven million tomans, the return on your investment will be ten percent in one year.

investment risk

When you put your money in the bank, you know how much the return on the deposit is. For example, in 1400, interest on short-term deposits was announced as 16%. But the return on your investment is not always so washed and gone. For example, before investing in coins or stock exchanges or digital currencies, you cannot be sure how much profit you are going to get. This is where the discussion of investment risk comes up: that is, you bear a certain amount of risk by investing in most markets.

A general rule is that the higher the potential profit of an investment, the higher the risk. A concrete example is the comparison between investing in digital currencies compared to investing in bank deposits. Depending on how long you keep your money in the bank, you can earn between 16 and 20 percent interest. Compare this rate of return with the several thousand percent profits that some digital currencies have given.

But the issue that should not be ignored is that by investing in digital currencies, you bear a very high risk. You may even lose a large part of your money. So, as a general rule of thumb, keep this in mind: higher returns almost always equal more risk.

The advantages of savings and investment compared to each other

Savings and investment can be compared in several aspects:

1- Efficiency

When we save our money, we don’t expect returns. Unless we consider putting money in the bank as savings. In this way, it can be said that the yield of savings is either zero or a small number. But in investment, depending on its type, we are faced with very high returns to very low returns – sometimes even negative.

2- Liquidity

Savings are usually very liquid. That means you can use your savings whenever you want. But we are facing different liquidities in various investment methods. For example, the stock you bought may not have a customer and you may have trouble cashing it for a few days. Or if you invest in real estate, it usually takes a while before you can turn it into cash.

3- Risk

Saving does not have much risk. But different investments have different risks.

4- Time goals

Savings are usually used for shorter-term goals. But when you invest your money, you probably have a longer-term view. This period of time may reach decades. Like parents investing in life insurance for their children.

When to invest or save?

As you can see in the picture below, if you invested in gold in 1400, for example, you would get 60.11% return. It means even less than a bank deposit.

But if we go back to a year ago, investing in gold could have yielded 73%.

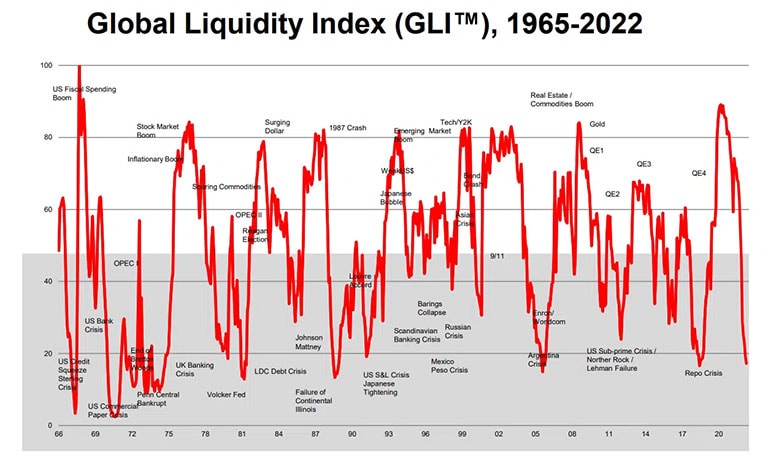

The point is that when the financial markets are depressed, it is better to save our money in the bank. But when the financial markets are booming, investment works much better than saving. The difference is quite evident in the two images above. Of course, it is not so easy to recognize whether markets are in recession or booming and it depends on many factors such as political issues and central bank policies. Therefore, to recognize it, it is necessary to sharpen our ears to the main economic trends.

How much of our money should we invest and how much should we save?

Having a diversified portfolio is always important. In depressed markets, it is better to save a larger part of our assets and invest a smaller part. But in booming markets, it is better to allocate a larger part to investment and a smaller part to savings.

Another important point is your risk tolerance, which we talked about above. Savings risk is almost zero and investment risk will be different based on its different methods. This is where the choice will be different for everyone.

Conclusion:

In a country that is always struggling with inflation, simple savings methods probably won’t save your capital from disappearing. Therefore, investment can be a better option. But it should also be considered that different investment methods have different risks. Therefore, to enter the world of investment, we must increase our knowledge in various financial fields as much as possible.

We are making a video program called Rahmanoon focused on personal investment in Rahevard, which we suggest you follow this video program if you are new to investing

- ۰ ۰

- ۰ نظر

چه زمانی به سقف چرخه بعدی بیت کوین میرسیم؟

چه زمانی به سقف چرخه بعدی بیت کوین میرسیم؟ Tether Claps Back at JPMorgan’s Stablecoin Skepticism

Tether Claps Back at JPMorgan’s Stablecoin Skepticism